-

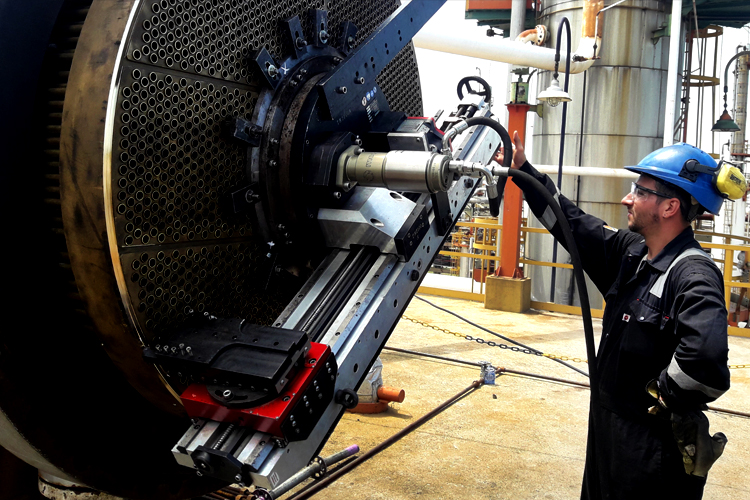

75 Años al servicios de la industria del petróleo y gasMáquinas y EquiposServicios

75 Años al servicios de la industria del petróleo y gasMáquinas y EquiposServicios

para la Industria -

Trabajamos bajo normasISO 9001, 14001,

Trabajamos bajo normasISO 9001, 14001,

45001 y 50001 -

Nuestro CompromisoExcelencia y laNuestro Compromiso

Nuestro CompromisoExcelencia y laNuestro Compromiso

Sostenibilidad

Nuestros clientes